US Treasury Secretary Expects De-escalation in US-China Trade War

US Treasury Secretary Scott Bessent expects a "de-escalation" in the US-China trade war, but notes that formal talks between the two nations have yet to start.

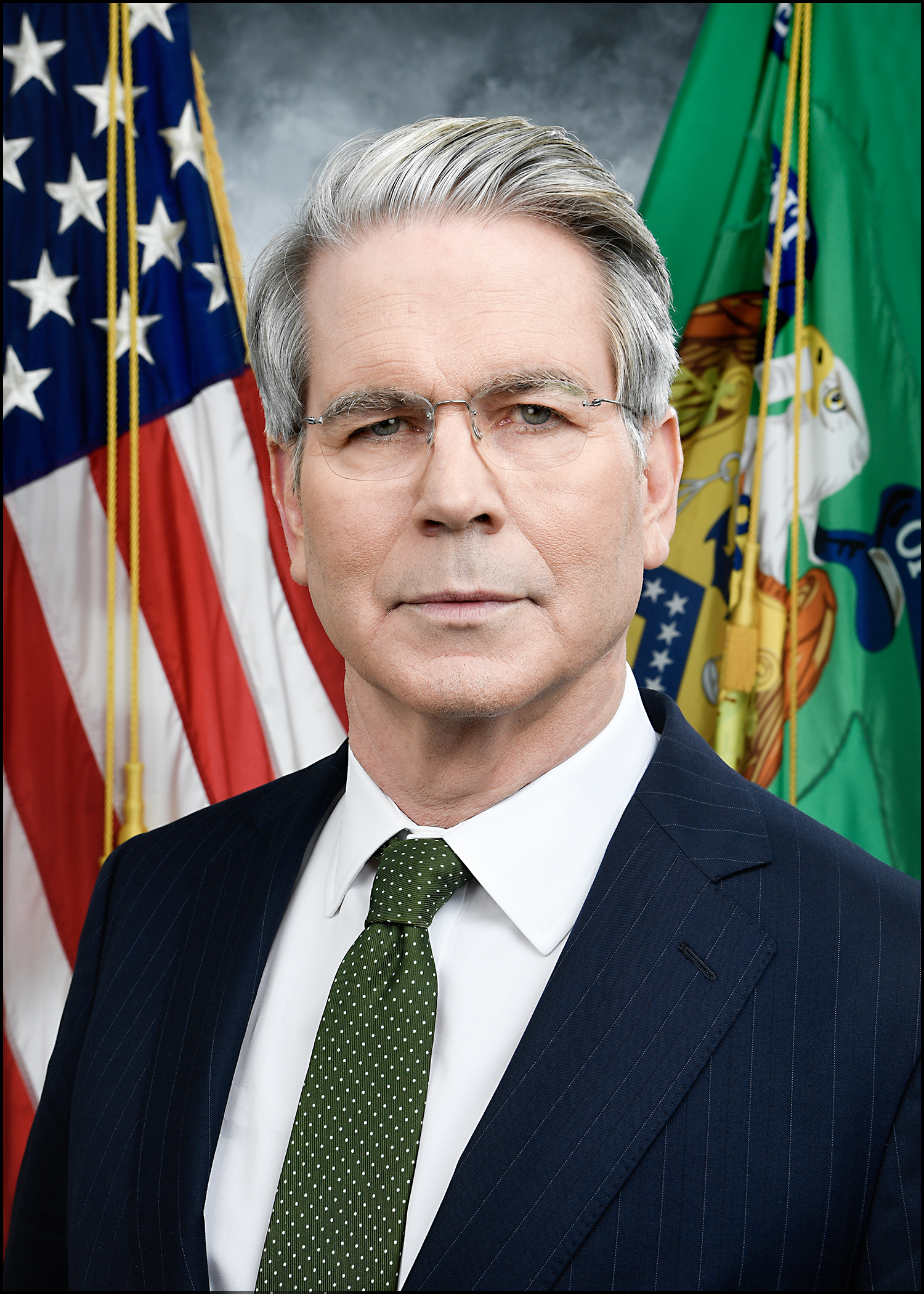

Scott Bessent Secretary of the Treasury Photo from (@US department of the treasury.gov)

Scott Bessent Secretary of the Treasury Photo from (@US department of the treasury.gov)WASHINGTON — U.S. Treasury Secretary Scott Bessent said in a speech that the ongoing tariffs showdown against China is unsustainable and expects a "de-escalation" in the trade war between the world's two largest economies. However, Bessent also cautioned that talks between the United States and China had yet to formally start.

According to a transcript obtained by The Associated Press, Bessent said, "I do say China is going to be a slog in terms of the negotiations. Neither side thinks the status quo is sustainable." The remarks were made in a private speech in Washington for JPMorgan Chase, and details were confirmed by two people familiar with the remarks who insisted on anonymity to discuss them.

The S&P 500 stock index rose after Bloomberg News initially reported Bessent's remarks. The Trump administration has met for talks with counterparts from several nations, including Japan, India, South Korea, the European Union, Canada, and Mexico. However, Trump has shown no public indications that he plans to pull back his baseline 10% tariff.

White House press secretary Karoline Leavitt told reporters Tuesday that Trump told her "we're doing very well" regarding a "potential trade deal with China." China on Monday warned other countries against making trade deals with the United States that could negatively impact China, saying, “China firmly opposes any party reaching a deal at the expense of China's interests.”

Leavitt said the Trump administration has received 18 proposals from other countries for trade deals with the U.S., adding that "everyone involved wants to see a trade deal happen." The uncertainty over tariffs in the financial markets has also been amplified by Trump calling on the Federal Reserve to cut its benchmark interest rate, with the president saying he could fire Fed Chair Jerome Powell if he wanted to do so.

Leavitt said Trump believes the Fed has been holding rates steady as it awaits the impacts of tariffs "in the name of politics, rather in the name of what's right for the American economy." Trump has placed import taxes of 145% on China, which has countered with 125% tariffs on U.S. goods, causing the stock market to stumble and interest rates to increase on U.S. debt as investors worry about slower economic growth and higher inflationary pressures.

Conversation