China’s Stock Market Rallies as Government Vows to Tackle Price Wars and Overcapacity

China's government signals a crackdown on destructive price wars and industrial overcapacity, boosting stock markets amid trade tensions and deflation concerns.

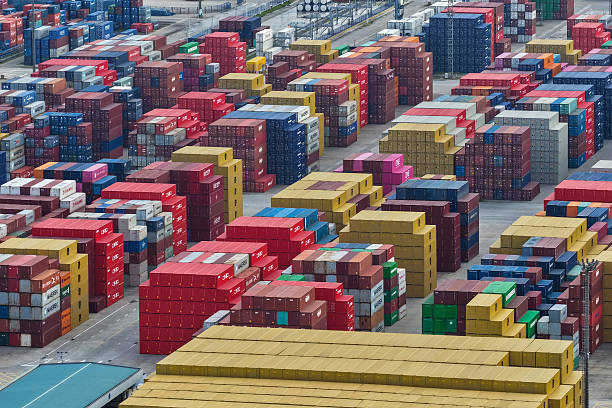

China Nanjing Longtan Port

China Nanjing Longtan PortChina’s stock market is rallying as the government signals a crackdown on intense price wars and industrial overcapacity that have slashed corporate profits and fueled global trade tensions. The renewed push to curb “involution” — a term used to describe destructive competition — is gaining traction across sectors such as steel, solar panels, and electric vehicles.

With domestic demand lagging and external pressure mounting due to higher tariffs, including those imposed by U.S. President Donald Trump, Chinese manufacturers have increasingly relied on price cuts to sustain sales. This has resulted in long-running deflation, with the producer price index falling steadily for nearly three years. The effects have spilled into global markets, prompting concerns among key trading partners in Europe and the United States.

In response, Beijing and various industry groups have issued new directives aimed at curbing the worst excesses. On June 30, China’s top 10 solar panel glass producers agreed to halt production and reduce output by 30%. The government also launched a vehicle safety inspection campaign to address concerns that automakers were compromising on quality to cut costs.

These measures sparked a stock rally in affected sectors. Shares of Liuzhou Iron & Steel Co. surged 10% on Friday, bringing total gains to more than 70% since the end of June. Changzhou Almaden Co., a solar panel glass manufacturer, saw its shares climb about 50% over the same period. Two exchange-traded funds focused on solar and steel rose around 10%, outpacing the Shanghai Composite’s 3.2% increase.

The performance of electric vehicle (EV) stocks has been mixed. Li Auto and Nio recorded double-digit gains, while market leader BYD declined.

While foreigners cannot buy Chinese stocks directly, they can invest in around 2,700 companies and 250 ETFs through the Hong Kong exchange.

The recent gains followed high-profile government statements labeling extreme price competition as “disorderly.” On June 29, the Communist Party’s flagship newspaper, *People’s Daily*, published a front-page article criticizing involution as contrary to China’s goal of high-quality development. President Xi Jinping, in a closed-door economic session, emphasized the need to regulate competition and local government incentives that have fueled overinvestment.

The government’s sharper rhetoric began in May, focusing first on EV price wars. UBS analysts said the shift could benefit auto sector profits, noting that while a complete industry turnaround is unlikely, a short-term pause in the price war is possible.

Following a May 23 round of price cuts by BYD, auto industry leaders, associations, and the government all called for fairer competition. The EV battery sector, cement producers, and construction firms also echoed the call to end unsustainable practices.

The term “involution” — or “neijuan” — originated in social commentary on the struggles of Chinese youth facing stagnant wages and limited opportunities. In an industrial context, it now describes sectors with too many companies battling for limited demand, leading to survival-driven price slashing.

The Communist Party journal *Qiushi* recently highlighted the mismatch between production capacity and market demand as a core issue in sectors like steel, cement, solar panels, and electric vehicles — all suffering from overcapacity.

However, systemic challenges remain. Consolidation through bankruptcies and mergers is necessary, economists say, but such moves are often resisted by provincial governments eager to protect local enterprises and jobs.

Alicia García-Herrero, chief economist for Asia-Pacific at Natixis, noted that while recent government statements reflect growing awareness of the problem, the extent to which they will translate into meaningful action remains uncertain.

“How much is action versus words, I don’t know,” García-Herrero said. “But I do think it’s a big problem for China.”

Conversation